Send money easily and securely in 60+ currencies to over 200 destinations

As the world’s most global bank, we strive to provide you with the best ability to make international payments quickly and securely.

Full transparency

View competitive exchange rates and transaction amounts before confirmation

No transaction fees*

Send money transaction fee-free using Citi Online or Citi Mobile® UK App

Convenience

No need to hold an account in any of the 60+ currencies to send money – select any of your existing accounts to send from and we will do the conversion for you

*Exchange rate spreads still apply

*RUB and PLN available through branch only for now

Features of sending money using SWIFT on digital channels

As the world’s most global bank, we strive to provide you with the best ability to make international payments quickly and securely.

Full transparency

View competitive exchange rates and transaction amounts before confirmation

No transaction fees*

Send money transaction fee-free using Citi Online or Citi Mobile® UK App

Convenience

No need to hold an account in any of the 60+ currencies to send money – select any of your existing accounts to send from and we will do the conversion for you

*Exchange rate spreads still apply

*RUB and PLN available through branch only for now

Features of sending money using SWIFT on digital channels

Please have the following information ready before you send money abroad:

- The full name of the person or company you wish to pay

- The full name and branch address of the destination bank

- The BIC (Bank’s Identifier Code) or SWIFT code, plus the account number (or IBAN for European accounts) of the account to which you are transferring funds. You will need to ask the payee for this information

- The Intermediary bank name and BIC or SWIFT code (if applicable)

- The amount and currency you wish to transfer

- ABA number, sort code or BSB routing code (if applicable)

- Payment reference (if required)

- You may need to provide additional information depending on transfer destination

Ways to send money abroad

You can send money abroad in 3 ways:

- Online – simply sign on to your Citi UK Mobile App or Citi Online to request your SWIFT payments at any time

- By phone – through your Relationship Manager or CitiPhone

Please note there is a 3pm cut off time for same day processing.

Requests received after this time will be processed the following Banking Day. As a general rule, international funds transfers may take 1 to 5 Banking Days to be credited to the beneficiary bank. Citi cannot guarantee the exact time taken as this depends on the local and intermediary bank systems.

Citi clients click here to know more about how to transfer money online using Citi Online.

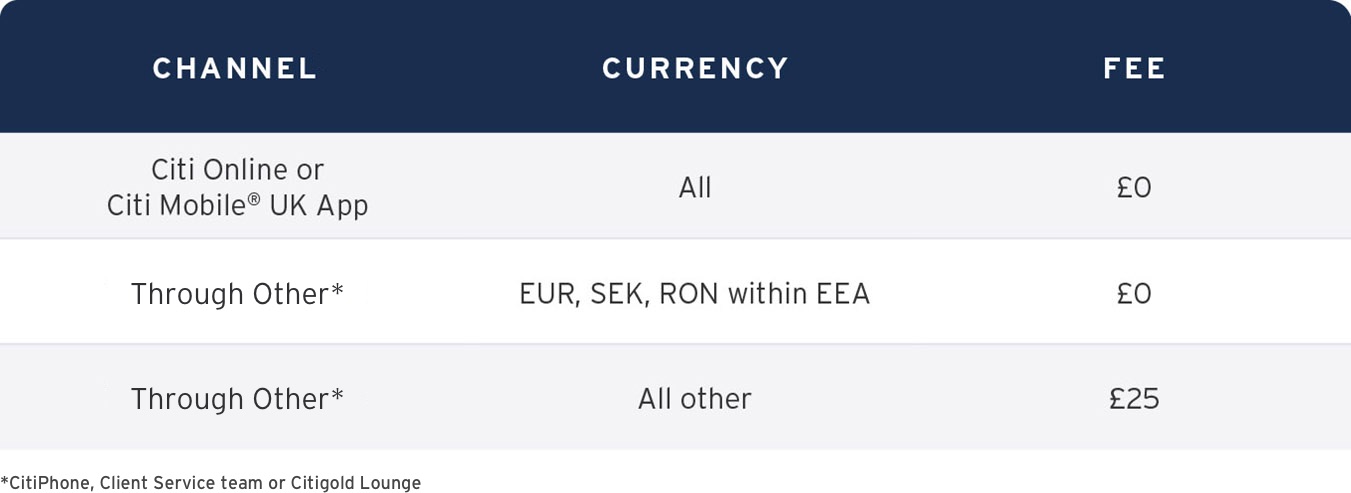

Fees for sending money abroad using SWIFT